Investments in India by NRIs

India is an attractive investment hub not just for Foreign Companies and Institutional Investors, but also for Non Resident Indians (NRIs). Soon India will become $ 5 Trillion economy and the whole world is participating in the same including NRIs. This article is aimed to answer the most basic but important questions that arises in one’s mind while talking about Investment in Indian Stock Market by NRIs.

Basic terminologies used throughout the article:

- NRI- a “person resident outside India” who is a citizen of India or is a person of Indian origin [as per FEMA regulations]

- Designated Bank Branch- Branches of Authorized Dealer Bank to conduct business under PIS on behalf of NRIs.

- Portfolio Investment Scheme (PIS)- Scheme of RBI under which NRIs can purchase/sell shares/convertible debentures of Indian companies on Stock Exchange

- Repatriation – This means NRIs can take funds out of India

- Non – Repatriation – This means NRIs cannot take funds out of India and the same must be utilized in India

Can NRIs invest in Indian stock market?

- NRIs are eligible to purchase shares and convertible debentures issued by Indian companies under PIS. The investment can be made through designated Authorized Dealers, on repatriation and/or non-repatriation basis.

- NRIs can also invest in Exchange Traded Funds on repatriation and/or non-repatriation basis. However, investment in Exchange Traded Derivative Contracts shall be made only on non-repatriation basis.

- NRIs can even participate in IPOs. The issuing company shall issue shares to NRIs on the basis of specific or general permission from the GOI/RBI.

- The investments can be made on delivery basis only. Intra-day trading/short selling is not permitted.

How can NRIs transact?

- NRIs shall open NRE/NRO account with the Designated branches of any one of the Authorized Dealer Banks.

- NRI can register with only one Authorized Dealer Bank and all investment transactions shall be routed through that bank itself.

- If the NRI wishes to repatriate the proceeds the he/she must open a NRE account. Funds from NRO account can be used in case of non-repatriation only.

Are there any restrictions on investment?

- Yes, NRIs are not allowed to invest in companies that are engaged/propose to engage in:

- Business of Chit Fund

- Nidhi Company

- Agricultural or plantation activities

- Real estate business* or construction of farm houses

- Trading in Transferable Development Rights

*Real estate business does not include construction of housing / commercial premises, educational institutions, recreational facilities, city and regional level infrastructure, townships

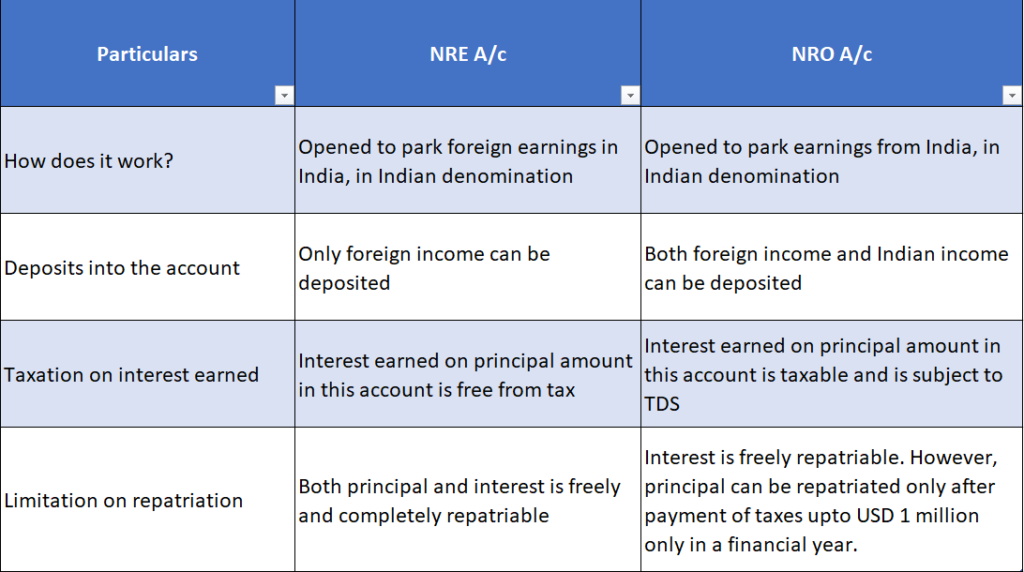

What is the difference between NRE and NRO Account?

Both Non Resident External A/c and Non Resident Ordinary A/c are type of bank accounts that can be opened by a Non Resident to park their earnings in India. Following are some of the points in which both accounts differ in nature:

What are the documents to be submitted?

- Document ensuring status of entity

- In case of Indian passport – Valid passport, Place of birth as India, Valid Visa – Work/Student/employment/resident permit etc.

- In case of foreign passport : Valid passport and any of the following

- Place of Birth as India in foreign passport

- Copy of PIO / OCI Card as applicable in case of PIO/OCI

- PIS Permission Letter from the respective designated bank

- PAN Card

- Overseas Address: Driving License/ Foreign passport /Utility Bills/Bank statement (not more than 2 months old)/ Notarized copy of rent agreement/ leave & license agreement/ Sale deed.

- Photograph of Investor.

- Proof of respective bank accounts & depository accounts.

What if the NRI becomes a Resident later on?

The NRI will have to inform the DADB (where PIS investments made) and the DP (where demat a/c is opened). A new demat account will have to be opened, the securities shall be transferred over to this account and the NRI demat a/c shall be closed.

How are the transactions taxed in India?

- In case of listed equity shares and equity traded funds long term capital gain is:

- exempt upto Rs.1,00,000.

- @ 10%* over and above Rs.1,00,000/-

- In case of unlisted equity shares long term capital gain is taxable:

- @ 20%* if cost of acquisition is indexed.

- @ 10%* without indexation of cost of acquisition.

- Short term capital gains in both cases is chargeable to tax:

- @ 15%* if the security is STT paid.

- @ applicable slab rates* in other cases.

- The proceeds received are subject to TDS. TDS is deducted on the capital gain amount at the aforesaid rates, as applicable.

*plus 4% cess and surcharge as applicable

CA Swati Bhat loves Income Tax and is hands on with taxation provisions applicable to NRIs.

She can be reached out to on [email protected]