Should Start-Ups opt for Reduced Income Tax Rate?

It’s August and it’s that time of the year where you need to start preparing for filing of Income Tax Returns for yourself and your company. Yes, the due date is extended to 30th November, 2020 but you still have to do it. (There is no escaping it, even COVID crises cannot help you here).

This year companies need to take a key decision on whether to opt for a reduced tax rate of 22% or not. At the outset it looks pretty simple and straightforward. As 22% is lower than the existing rate of 25% , going for 22% tax rate looks like an obvious choice. If only life and Income Tax Act were so simple to interpret and understand!!!! There are multiple factors that one needs to consider before going for the new rate of tax.

Inorder to discuss the same let us divide the companies in two categories:-

Category 1- New Domestic Manufacturing Company

- Set up or registered- on or after 1st October, 2019

- Manufacturing must be commenced- on or before 31st March, 2023

- New company should not be formed by splitting up or reconstruction of an existing business (this means don’t just open a new company to continue your old business)

- Should not use old Plant & Machinery. However, there are certain exceptions to this-

-If Machinery is Imported into India

-No deduction availed u/s 32

-Total value of such Second hand Plant & Machinery <= 20%

-If Machinery is Imported into India

-No deduction availed u/s 32

-Total value of such Second hand Plant & Machinery <= 20% of Total Plant Machinery

If above 3 conditions are satisfied, then the company may use old Plant & Machinery.

- Should not use any building previously used as a hotel or convention center.

- The company is not engaged in any business other than the business of manufacturing or production.

Category 2-

Every other Domestic company falls under this category.

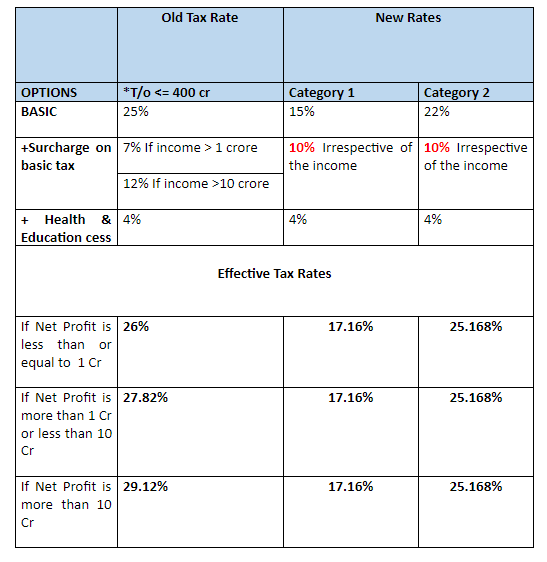

The table below is the summary of tax rates applicable to domestic companies whose turnover is less than or equal to 400 Cr.

As seen from above, there is significant tax benefit if a company falls in Category 1. However, if you don’t fall in Category 1 broadly speaking if you are not into manufacturing and net profit of your Company is less than 1 Cr(i.e. of MSME companies) then the tax benefit is not significant.

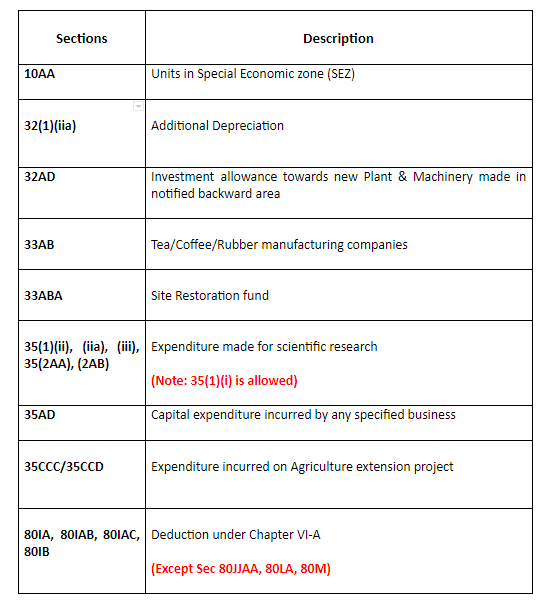

Further, to gain the benefit, companies have to relinquish the below mentioned Deductions/Exemptions-:

Above our specific benefits provided to companies operating in certain sectors.

- Carried forward losses or unabsorbed depreciation which are attributable to any of the above referred deductions shall not be available to set off.

It’s worthwhile to note that only the carry forward loss or unabsorbed depreciation attributable to above provisions is not allowed to be carried forward. However, normal carry forward of loss and unabsorbed depreciation can be carried forward.

2.Effect on Minimum Alternate Tax (MAT)

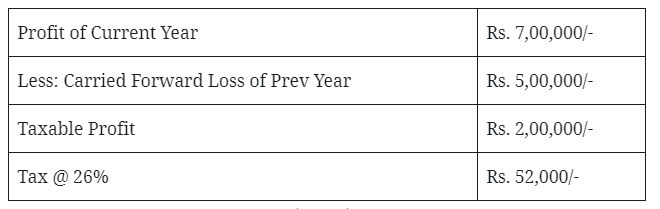

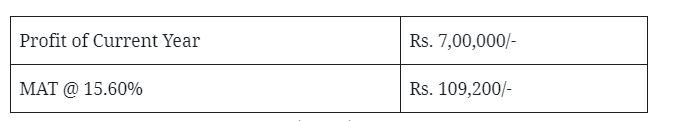

MAT Provisions are not applicable to companies opting for reduced income tax rates. MAT means Minimum Alternate Tax which compelled companies to pay a minimum tax irrespective of carry forward of losses amongst other things. In layman terms let us say in Year 1 a company had incurred a loss of Rs. 5,00,000/-. Company does not have to pay any tax in Year 1 and the loss gets carried forward to next year. In Year 2, Company earns a profit of 7 Lacs. Tax to be paid will be calculated on the basis of higher of below-

1) At Normal Tax Rate

2) MAT

So in normal course the company has to at least pay Rs. 109,200/- irrespective of carry forward loss.

However, the difference of MAT Tax and Normal Tax i.e. Rs. 57,200/- (Rs. 109,200- Rs. 52,000/-) can be carried forward as “MAT Credit Entitlement” and can be used whenever Tax payable at Normal Tax Rate is more than Tax Paid under MAT.

One of the conditions of shifting to the new reduced income tax rate is that this “MAT Credit Entitlement” has to be foregone. So, in our example if company shifts to new tax rate it has to forego MAT Credit Entitlement of Rs. 57,200/-

Now, this has to be diligently checked for each case i.e. after foregoing MAT credit entitlement whether shifting to reduced tax rate is beneficial or not. Answers to that will vary from case to case basis.

NOTE:- The rate of MAT is reduced from 18.5% to 15% .

It is worthwhile to highlight that once the concessional tax scheme is exercised, it cannot be withdrawn for any of the subsequent years.

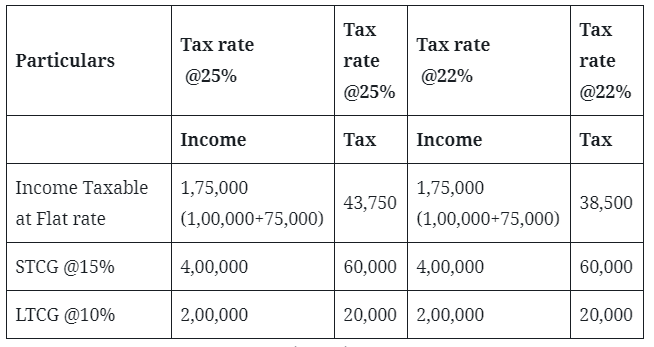

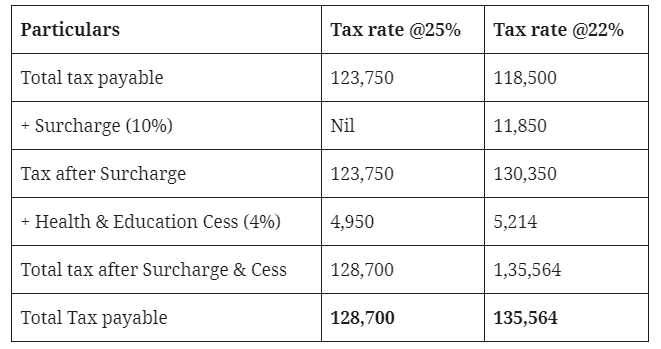

One more important factor to be taken into account is that if a company opts for a new tax rate surcharge of 10% is applicable on total tax i.e. even on capital gain tax. So the effective tax rate of STCG on shares becomes 17.16% and Long Term Capital Gain on shares becomes 11.44% when a company opts for a new rate of Tax. Whereas, if company opts for old rate of tax effective tax rate of STCG is 15.60% and on Long Term Capital Gain is 10.40%

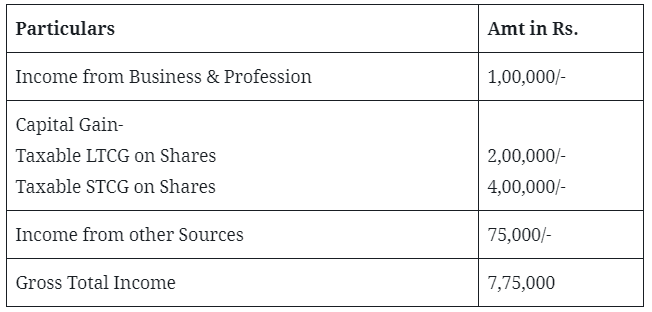

LET’S GET CLARITY THROUGH AN EXAMPLE

In the above example the old tax rate scheme is more beneficial since the company’s total turnover was less than 1 crore, due to which Surcharge was not applicable. Whereas, under the new tax regime, the Surcharge is levied irrespective of Income.

Once again this will vary from case to case basis but companies will have to be very diligent while deciding whether to go for a new rate of tax or continue with the old rate of taxes.